Unlocking Efficiency: How Accounting Software Transforms Your Business

In today's fast-paced business environment, efficiency isn't just a goal; it's a necessity for survival and growth. Companies of all sizes are constantly looking for ways to streamline operations and enhance productivity. One of the most impactful tools available for achieving this is accounting software. By automating financial processes and providing real-time insights, this technology transforms how businesses manage their finances and make strategic decisions.

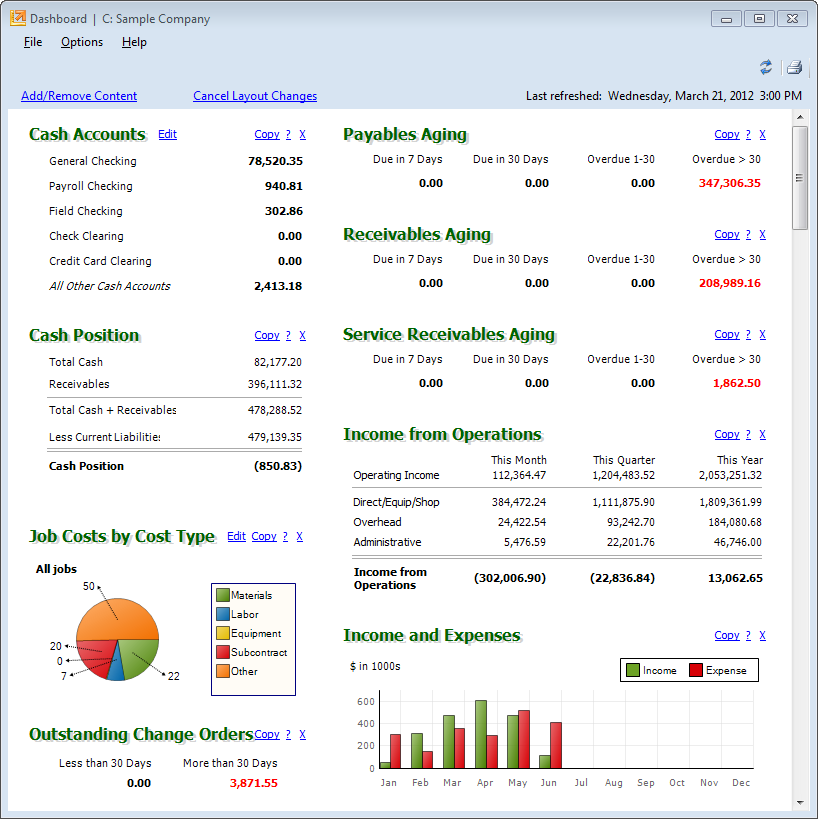

Accounting software for business offers a wide array of benefits that go beyond simple bookkeeping. It helps organizations save time, reduce errors, and gain a clearer understanding of their financial health. With features like automated invoicing, expense tracking, and comprehensive reporting, businesses can focus more on their core activities while ensuring that their financial data remains accurate and up-to-date. Embracing this software can lead to smarter decision-making and ultimately, greater success in the competitive marketplace.

Benefits of Accounting Software

Accounting software for business streamlines financial management, allowing companies to automate numerous tasks that were once time-consuming and prone to human error. With features such as automated invoicing, payroll processing, and expense tracking, businesses can save valuable time and resources. This not only enhances productivity but also enables staff to focus on more strategic initiatives rather than mundane accounting chores.

Another significant advantage is the improved accuracy in financial reporting. Accounting software reduces the risk of errors that can occur with manual calculations, ensuring that businesses maintain precise and up-to-date records. This accuracy is crucial for making informed financial decisions, meeting regulatory compliance, and fostering trust with stakeholders. Reliable financial data enables business leaders to analyze performance and identify growth opportunities with confidence.

Cost savings are also a notable benefit of implementing accounting software. By reducing the need for extensive accounting staff and minimizing the time spent on financial tasks, businesses can lower operational costs. Furthermore, many accounting software solutions offer scalable pricing plans, making them accessible for small to medium-sized enterprises. This affordability, combined with the potential for increased revenue through better financial management, makes accounting software an essential investment for modern businesses.

Choosing the Right Software

Selecting the right accounting software for business can significantly influence your company's financial health and operational efficiency. Start by evaluating your specific business needs and processes. Consider the size of your business, the complexity of your financial transactions, and the level of detail you require in reporting. A one-size-fits-all solution may not suit every organization, so tailoring your choice to your unique requirements will lead to better results.

Next, explore the features offered by different accounting software solutions. Look for functionalities such as invoicing, expense tracking, payroll management, and tax compliance. Integration capabilities with other tools you use, like CRM systems or inventory management, can enhance your overall workflow. Additionally, assess user-friendliness, as software that is intuitive will reduce training time and promote adoption among your team.

Finally, consider cost implications and support options. While some accounting software for business may require a higher initial investment, the long-term benefits can outweigh the costs. Check if they offer subscription models or one-time purchases, and weigh these against your budget. Also, prioritize software providers that offer reliable customer support, as having assistance readily available can be crucial when troubleshooting issues or seeking guidance on advanced features.

Implementing Accounting Solutions

Implementing accounting software for business can significantly streamline financial processes. By automating routine tasks such as invoicing, expense tracking, and payroll management, businesses can reduce the time spent on manual calculations and data entry. This automation not only minimizes errors but also allows staff members to focus on more strategic activities that drive growth. As a result, companies can improve overall productivity and ensure that their financial data is current and accurate.

Choosing the right accounting software is crucial to maximizing its benefits. Businesses should assess their specific needs, such as the size of the company, the complexity of financial transactions, and the reporting requirements. Some software solutions offer scalability, meaning they can grow with the business. Moreover, businesses should consider user-friendliness and customer support when selecting their accounting software. This ensures that employees can easily adapt to the system, facilitating a smoother transition and prompt resolution of any issues that may arise.

Once implemented, ongoing training and support are essential to fully leverage accounting solutions. Regularly updating staff on new features and best practices can enhance the user experience and keep everyone informed about changes in financial regulations or software updates. Additionally, monitoring the software's performance and gathering feedback from employees can lead to further improvements. By embracing these steps, businesses can ensure that their accounting software remains a valuable asset, continuously contributing to efficiency and accuracy in their financial management.